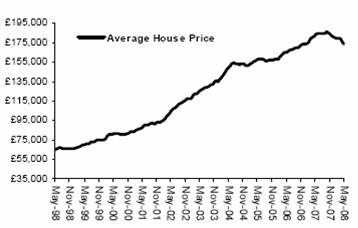

According to the latest house price index figures compiled by Nationwide, house prices fell by 2.5% in May. This is not only the largest drop since the building society started compiling a monthly index in January 1991 but also its seventh consecutive monthly fall. Gloomy news indeed, bearing in mind that if the data is accurate, the month has wiped out about £4,500 off the value of the average property. To put that in perspective; if that happened every month, it would wipe a whopping £54,000 off the value of an average house, in one year.

Nationwide say that the price of a typical house is now £173,583, which is £8,000 less than this time last year. They also state that house prices are 4.4% lower than this time last year, which is the biggest annual fall since 1992 when prices were falling at the rate of 6.3% per annum. However, because of previous sustained growth of house prices up until last year, prices are still 5% greater than two years ago and 10% greater than three years ago.

The Nationwide are not alone in their weak economic sentiments in reference to the housing market. The Bank of England reported an 11% monthly drop in house purchase approvals in March and the Royal Institute of Chartered Surveyors cited the most widespread regional falls in house prices in the history of their series. So once again, with higher prices of essential items weakening consumer spending power, the Bank of England find themselves under pressure to cut interest rates next month.

On a more positive note, the building society stated its beliefs that homeowners are better equipped to weather the storm this time around than in the 1990s. These reasons are threefold:

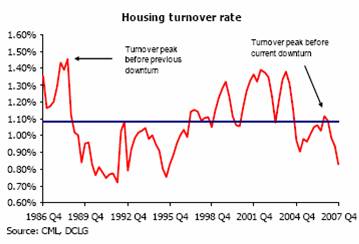

1. Fewer homeowners bought at the peak of the market in this cycle, compared to a much higher proportion that purchased at the very peak of the market in the late 1980s. This means a much smaller proportion face the full effects of price falls this time around.

2. Todays house buyers have typically put down a larger deposit than those of their 1980s counterparts. In 1988-89, 44% of loans for house purchase were for more than 90% of the property value. This compares with only 31% borrowing this loan-to-value ratio in 2006-07.

3. In the latest housing boom, more people opted to pay off capital, rather than just interest. A massive 85% of home buyers took out interest-only mortgages in 1988-89 (a reflection of how popular endowment policies were at the time), compared to only 30% in 2006-07. This means that the majority of borrowers will have repaid some capital and therefore be in a better underlying equity position.

Nationwide also believe that tighter lending criteria will lead to a more sustainable market. Fionnuala Earley, Chief Economist at Nationwide said: “Tighter credit conditions in the market at present are making it more difficult for borrowers to obtain loans at higher loan-to-value ratios. While this is frustrating for those in that position, more stringent underwriting criteria should ultimately lead to fewer overstretched borrowers and hence a more stable and sustainable market.†So what happens next? Well according to the Nationwide Consumer Confidence Index for April, consumers expect house prices to fall 1.7% over the next six months. That would be welcome relief indeed after the market saw such a dramatic fall over the period of only one month.

Welcome...kkk. toOur Latest Articles fgdfhgdfgdfgdfgdfgdf

Welcome...kkk. toOur Latest Articles fgdfhgdfgdfgdfgdfgdf